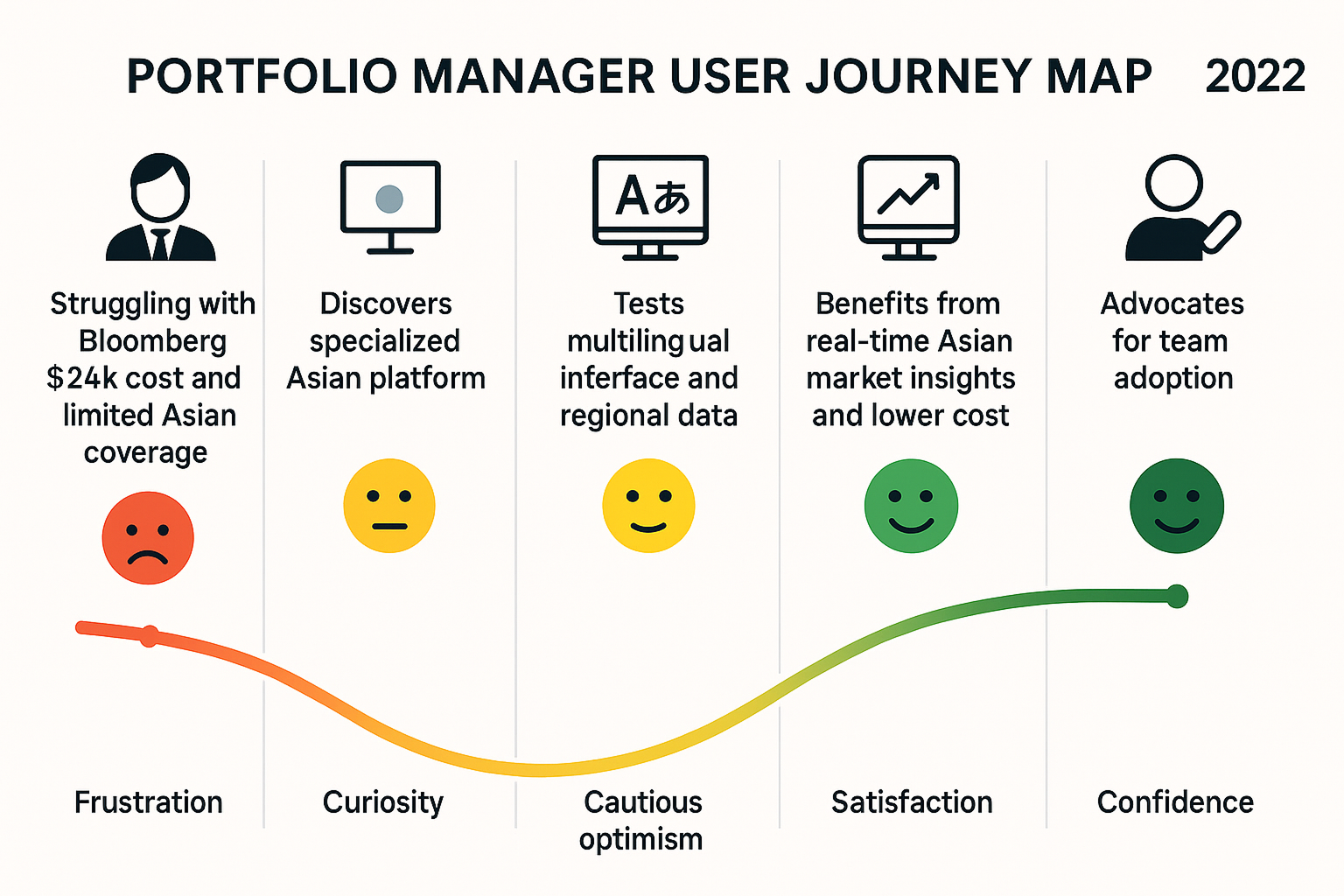

This intensive, five‑day workshop focused on shaping the product vision for an “Asian Bloomberg”, a working title for a news and finance startup. The sprint progressed through key phases: Research & Discovery to understand market needs and user motivations, Concept Ideation & Prototyping to translate insights into tangible solutions, and User Testing to validate usability and refine the prototype based on real feedback. The outcome was a low‑fidelity concept that aligned business goals with user expectations, setting the foundation for further product development.

Value Proposition&Product Vision Board

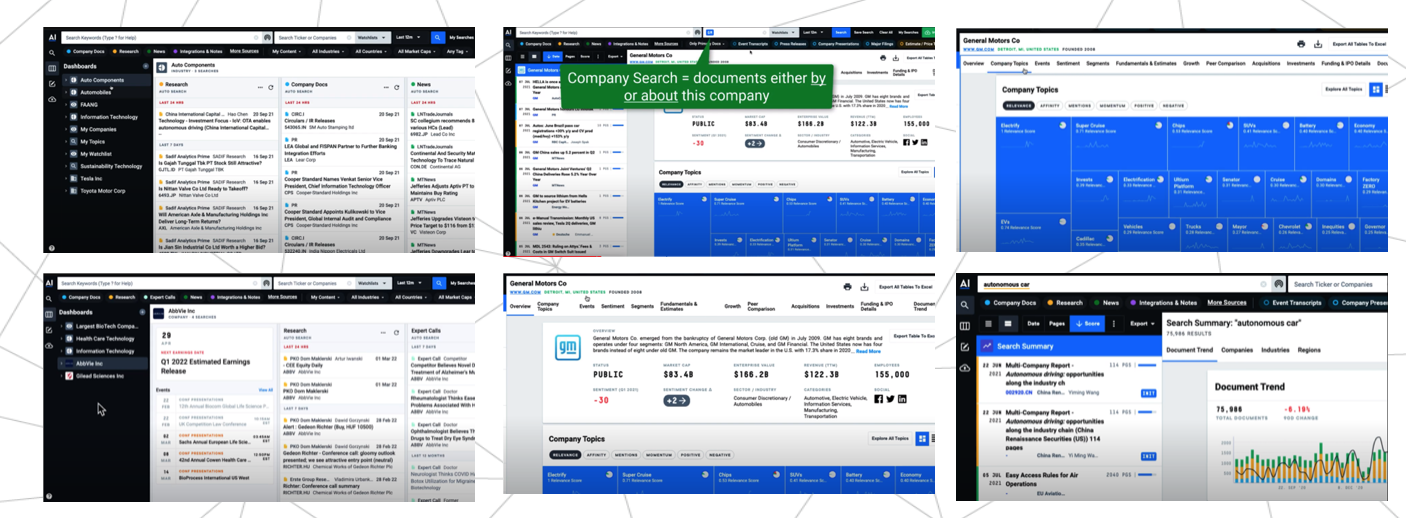

A new market intelligence product tailored specifically for the Asian market is uniquely valuable because leading platforms like Refinitiv, Bloomberg, and AlphaSense consistently overlook the region’s requirements. These global tools suffer from steep learning curves, inefficient interfaces, lack of robust local financial data, and an absence of ASEAN-centric perspectives. By prioritizing regional relevance, intuitive navigation, and authoritative Asian-market insights, a dedicated product addresses the critical content and usability gaps faced by local users—delivering actionable value, faster onboarding, and significantly improved business decision support for the region.

Key Challenges and Competitor Analysis

One of the challenges worth underline is that stakeholders dialed in from various locations in Asia, which presented challenges such as time zone differences and occasional connectivity issues. Some participants accessed the Miro boards via mobile phones, which sometimes limited their interaction but allowed real-time collaboration. Despite these technical constraints, the team progressed systematically through each phase, ensuring all voices were heard and every step—from initial research to final prototype development—was completed collaboratively and effectively.

The feature and functionality gap analysis from an ASEAN perspective reveals several shortcomings among top market intelligence platforms. Refinitiv is hindered by data overload, a steep learning curve, and the absence of an ASEAN-centric view. Bloomberg struggles with an outdated interface, high learning curve, inefficient navigation, limited personalization, inconsistent experience, reliance on user memory, and also lacks ASEAN-specific content. AlphaSense, while strong in news and documents, lacks robust financial data and does not provide an ASEAN-centric perspective. Collectively, these platforms fail to address the specific needs of ASEAN users, particularly in localized content and user experience.

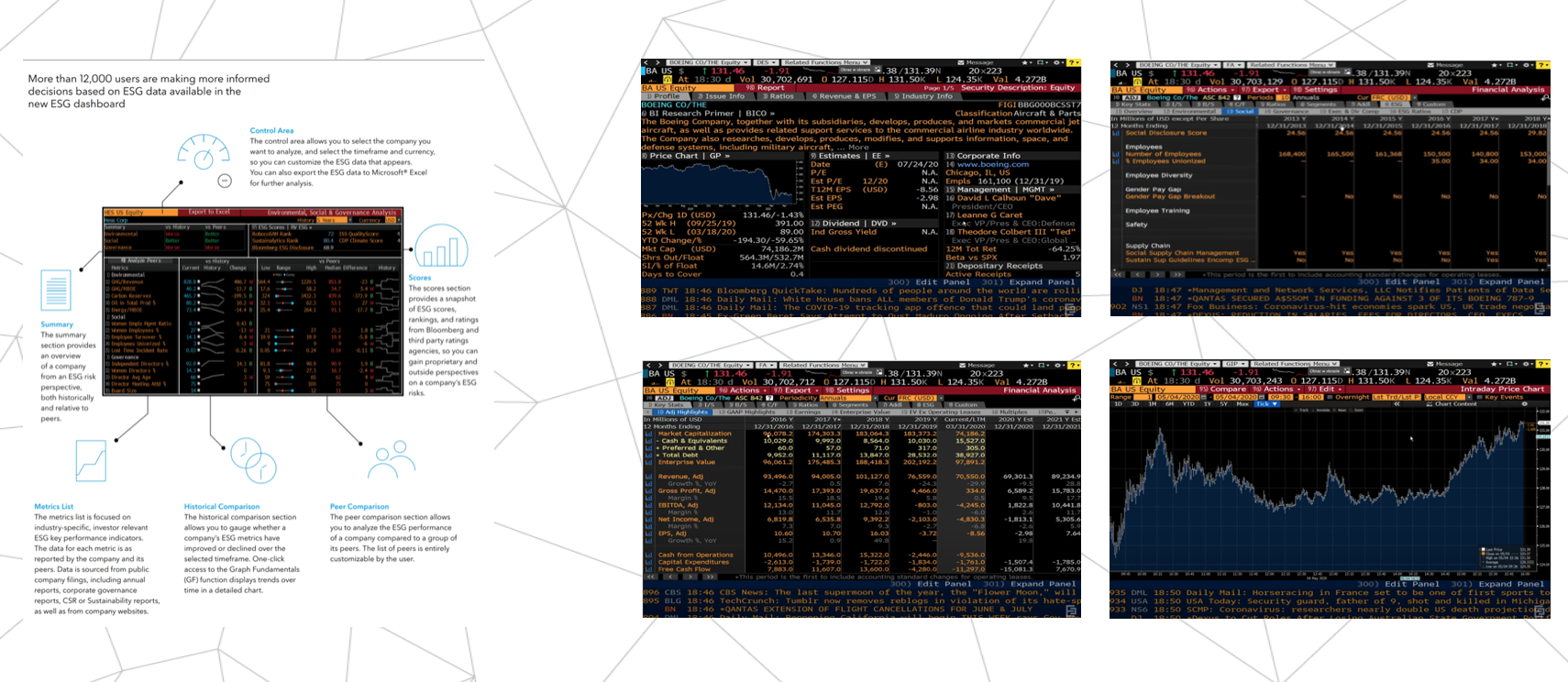

Examples of low -fidelity Mockups

During next steps we produced low‑fidelity mockups and facilitated user testing with representative business users across Asian markets.

Example layouts include interactive world maps—one showing supply chain routes and another networked overview of supply nodes and connections. To the right, there's a module for displaying map visualizations and possibly different regional data views. Below the maps, there's a section for peer group analysis, likely displaying comparative performance and metrics for selected companies. The interface also features detailed price tables and related statistics, allowing users to track changes, compare different entities, and monitor key supply chain indicators in a centralized workspace. The overall design emphasizes quick access to data visualization and comparative analysis tools.

Second example mockup presents a dashboard for a semiconductor industry analytics area. It features interactive modules for supply chain mapping, industry news aggregation, peer group analysis, investment opportunities, company operations, and market share visualizations.

The left sidebar provides filters by country, enabling users to tailor data insights for markets like Singapore, Indonesia, Vietnam, and others. Each module offers actionable charts, data tables, and tools to input or compare companies, sectors, trends, and regulatory categories, supporting efficient decision-making for business professionals.

User testing feedback provided valuable insights regarding navigation clarity, data relevance for local supply chains, and the usability of analytics modules. As a result, several mockup elements were refined to better align with the expectations and regional business practices of key ASEAN stakeholders.

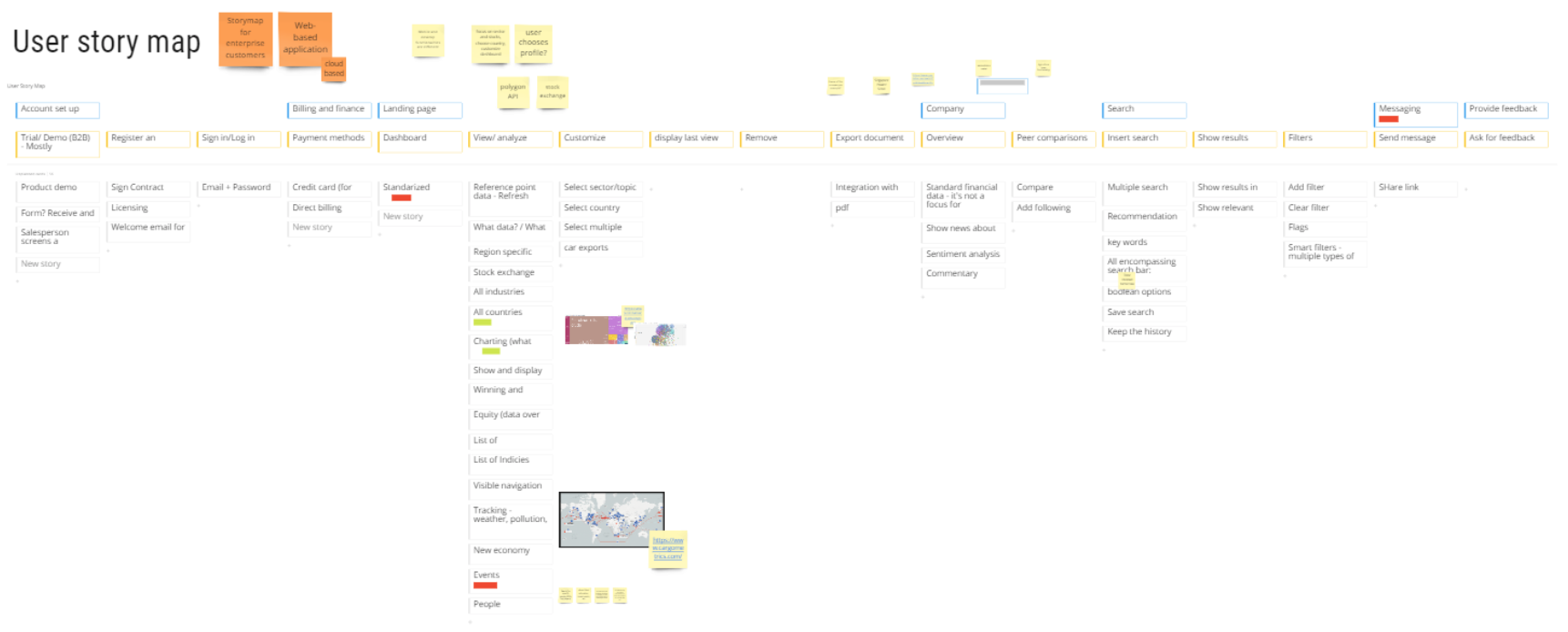

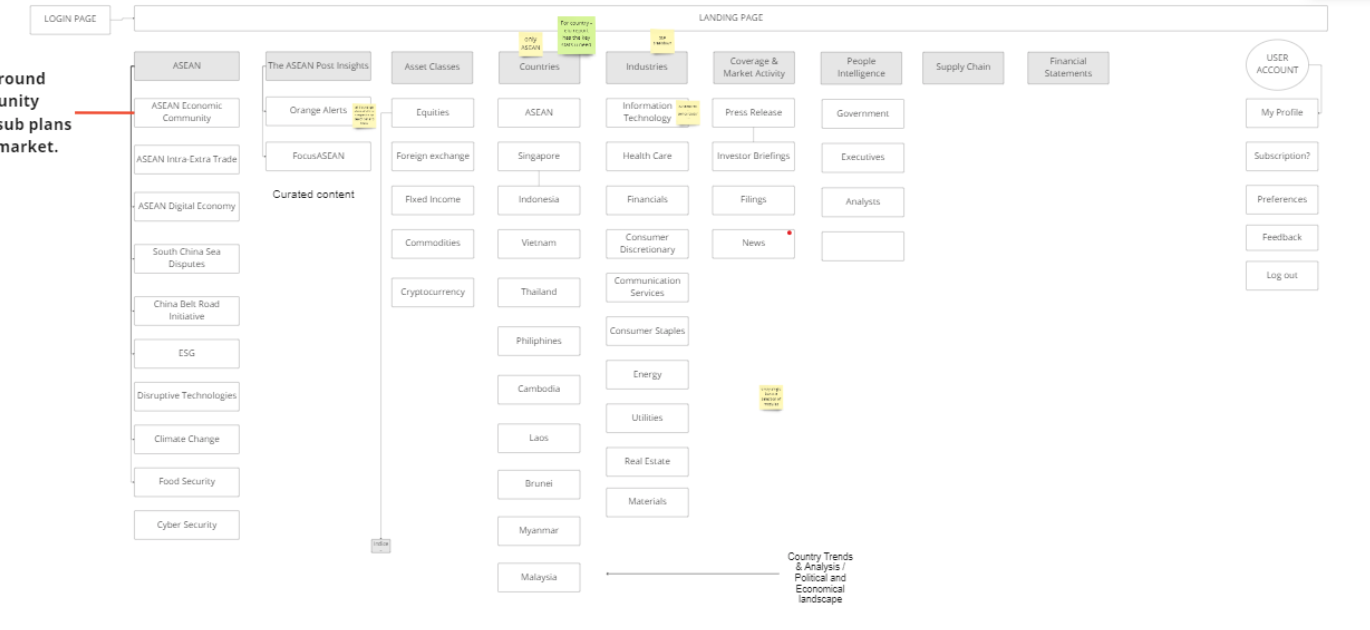

User Story Map& IA

The user story map organizes the main actions users take on the platform, including onboarding, managing payments, searching, analyzing, and exporting data, all the way to messaging and feedback. It details user goals and interaction flows, from signing up and viewing demo products to customizing dashboards and comparing reports.

Synthesized with the information architecture, these documents create a robust plan for an ASEAN-focused market intelligence product. The architecture ensures all key content—like economic topics, industries, market activity, and account settings—is logically structured and accessible. The story map complements this by mapping out user journeys and required features at each step. Together, they guarantee the final platform is clear, scalable, and tailored to the needs and workflows of regional users, supporting both simple tasks and advanced data analysis.